Used by elite multinational banks of all sizes, Winbank serves primarily the needs of investment banks and those that require customized solutions to meet specific business needs.

Low profitability, competitive and regulatory pressures, and risk management requirements make it harder for banks to grow their business.

In the face of these obstacles, financial institutions now require immediate and real time access to complete and accurate financial information.

In order to compete, banks need to quickly launch products while conforming to best practices and regulations.

They are turning to straight through processing that eliminates labor-intensive, manual processes, thereby saving time, reducing error and mitigating operational risk.

BIS’ banking solution Winbank helps banks improve customer loyalty and retention, launch new products and services quickly, monitor profitability, comply with regulations, and enter new markets confidently.

Winbank Banking Solution provides a scalable, customer-centric and integrated core banking system to help banks compete in an environment of intense competition.

The solution;

- Provides retail and commercial banking capabilities

- Handles deposits, lending, payments, trade and treasury modules

- Integrates accounting and business

- Offers a scalable and flexible open platform technology

- Delivers quick implementation via proven methodologies

- Provides conventional and Participation banking

Being the core of the system, this section contains the basic accounting structure, the customer database and the general system and user parameters.

System Management: Through system management, you can maintain certain parameters that set the working principles of your institution so that you can design the control and work-flow accordingly as well as maintain standard variables parametrically.

Accounting: Users can maintain a chart of accounts in accordance with the working patterns of the institution, issue financial statements, access to account balances and movements as of desired dates. With this accounting structure, you can produce regulatory books, issue balance sheet and profit/loss account, and make rediscount/evaluation transactions. You can also maintain financial statements parametrically, and produce the desired financial statement in a flexible way.

Customer Database: Thanks to customer-centricity of Winbank, it has become easier to continuously monitor and measure the performance of your client base on a global basis. With Winbank, adopting required marketing activities takes less effort than before.

Security: You can maintain user access rights and differentiate authorizations such as transaction limits, reporting or execution rights

Encompassing all the applications related to deposits, this section has a structure which allows for performing all inter-branch transactions online. Deposit related functions which are carried out by cashiers and back-office employees are performed based on a "work flow" logic. This section incorporates control and alert functions on the basis of transaction types, operating by using the parameters and definitions referred in the Kernel section of the system.

Perform cash, cheque, remittance and EFT transactions

Make foreign currency cash transactions (purchase/sale)

Make international remittances

Process foreign currency cheque collection/purchase

Process Foreign currency cheque drawing

Transfer transactions

Perform teller vault reconciliation

This is a module consisting of programs used to make transactions on cheques and bills received from customers for collection of proceeds or as collateral of loans. The Cheques and Bills module supports a full integration with the Loans Module.

Enter payrolls

Send/receive cheques to/from clearing house

Receive clearing results

Return cheques

Perform cheque payments

Integrate with cheque reader devices

Process foreign currency cheques

Control blacklists

The Retail Loans module covers the loan applications, utilisation, approvals and loan repayment functions.

Prepare various options through installment plan scenarios

Employ effective risk management by checking blacklists

Automate loan application, approval and disbursement processes

Make installment payments

Close credits and create accounting slips automatically

Get detailed reports and continuously monitor your enterprise’s risks

The Retail Loans module covers the loan applications, utilisation, approvals and loan repayment functions.

Prepare various options through installment plan scenarios

Employ effective risk management by checking blacklists

Automate loan application, approval and disbursement processes

Make installment payments

Close credits and create accounting slips automatically

Get detailed reports and continuously monitor your enterprise’s risks

Through the Import module you can follow up and report the import file data, perform provision, documentation, policy, transfer, value increase/decrease and file closure transactions and legislation controls related to imports.

File opening

Correspondent bank approval

Document handling

Transfer

Draft handling

Expenses and commissions

Designed for fixed income securities transactions, the Fixed Income module covers purchase/sale and repo transactions made by means of various instruments (e.g. treasury bills, government bonds, income sharing notes, wholesale price index, consumer price index) in the securities markets. Unit cost and funded costs of stocks can be monitored separately or proportionally. The announcements of the Istanbul Stock Exchange and the Central Bank related to the transactions can be monitored and reported at a certain range of dates.

Treasury bills and government bonds

Repos and reverse repos

Optional repos

Commission based customer deals

Multi level portfolio and stock management

Pricing for branches

Monitoring cost of stocks, P&L calculation

Assignment of stocks to repos

Automatic recovery for cost calculations

EMKT integration (Electronic Securities Transfer System - ESTS)

Winbank is fully compliant with Turkish market regulations. With a parametric structurethe system can flexibly produce mandatory reports that are sent to regulatory bodies such as the Ministry of Treasury, the Central Bank, and the Capital Market Board. It can produce 150 of around 170 statutory reports by means of the in-built reporting tool.

Decrease manual processing and free up your staff

Create report templates with minimum modification effort

Get compliant quickly and focus on your core business

Webbank, the Internet Banking Solution, allows the individual and corporate customers to use the home and office banking functions around the clock for 365 days a year. The customers can obtain banking services by connecting via the Internet or Extranet from their home or office. In addition to the customer number in the banking system, the customers are given a security code and password to access to the Internet banking module. Thanks to its flexible and scalable structure, the system provides comprehensive services to many customers simultaneously.

Empower your customers to perform transactions on their own

Reduce your operational burden and costs

Use the Internet as a supportive service channel

ATM Integration

POS Integration

Credit Card Integration

Credit Cards

Credit Cards – BankSoft Credit Card Package Integration

IVR Integration

On-line Turk Telekom Transactions

Social insurance premium collections

Utility collections

Tax collections

School tuition installment collections

Payment of staff salaries

Credit card payments

Domestic payment process management with EFT (Electronic Funds Management)/EMKT (Electronic Securities Transfer System)/FAST (Retail Immediate Payment System).

Outgoing message creation

EFT message templates

Release/Auto release

Queue process and inquiry

Partial message creation

Netting processes

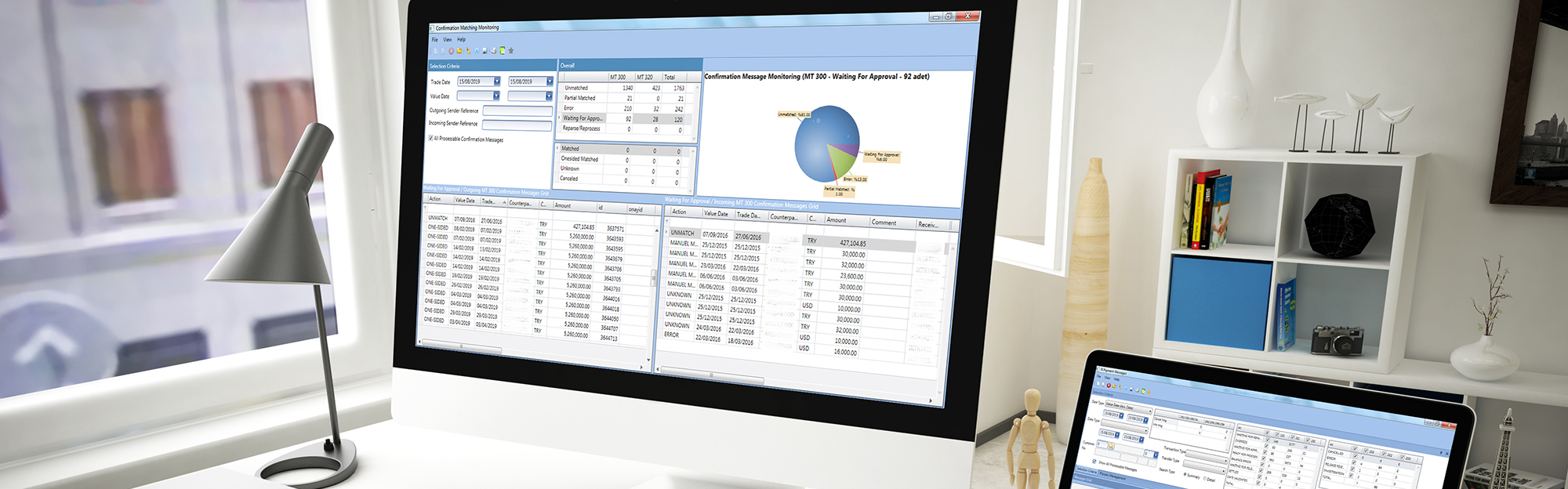

Automated matching processes

Automated incoming return of payment processes

Forward value payments

Auction messages

Integration with Central Bank of Turkey

Rich reporting

Fully automation integrated with any Swift system.

Message Definitions

BIC Code Definitions

BIC Code - EFT Code Mapping

Corresponding Bank Definitions

SSI Definitions

Rma Definitions

Currency Calendars

Cut-off Definitions

Format Validations

Data Validations

Release

Settlement

Expectation Matching

With the Central Bank of the Republic of Turkey's Fund Instant and Continuous Transfer of Funds (FAST) process, users can quickly and easily transfer funds between their accounts at different banks 24 hours a day, 7 days a week and banks/payment institutions notify the parties to the transaction of the transaction result as an instant notification.

WinPAY product is directly integrated into the FAST system and provides system support that banks and payment service providers can use in their payment processes.

Som of the advantages WinPAY offer are as follows:

- 24/7 Instant Payment Service

- Payment in Seconds

- Full Compliance with Message Structures

- Limit Rules

WinPAY is Windows/Unix/Linux based and provides the opportunity to work on Oracle, MS SQL and other databases and has a flexible structure in the integration process.